7 Signs That You Are Ready For Home Ownership

7 Signs That You Are Ready for Home Ownership

Deciding to buy a home is one of the most significant financial decisions you will ever make. It’s not just about having a place to live; it’s about investing in your future and establishing roots in a community. But how do you know if you’re truly ready for this big step? Here are seven signs that indicate you’re prepared for home ownership.

1. Stable Income and Employment

A steady job and reliable income are crucial when considering home ownership. Lenders want to see that you have a consistent source of income to ensure that you can make your mortgage payments on time. If you've been in your current job for at least two years and have stable earnings, this is a strong indicator that you’re ready to take on the responsibilities of owning a home.

2. Good Credit Score

Your credit score plays a significant role in determining your eligibility for a mortgage and the interest rates you'll receive. A score above 620 is generally considered acceptable by most lenders, but higher scores can secure better rates and terms. If you've been diligent about paying off debts and managing your finances responsibly, your good credit score may be a sign that you're ready for home ownership.

3. Savings for Down Payment and Closing Costs

Buying a home often requires a substantial upfront investment, including the down payment and closing costs. Ideally, you'll want to save at least 20% of the home's purchase price to avoid private mortgage insurance (PMI). However, there are various programs available for first-time buyers that allow lower down payments. If you have a solid savings plan in place and are financially prepared to cover these costs, you're likely ready to leap into home ownership.

4. Understanding of Your Local Market

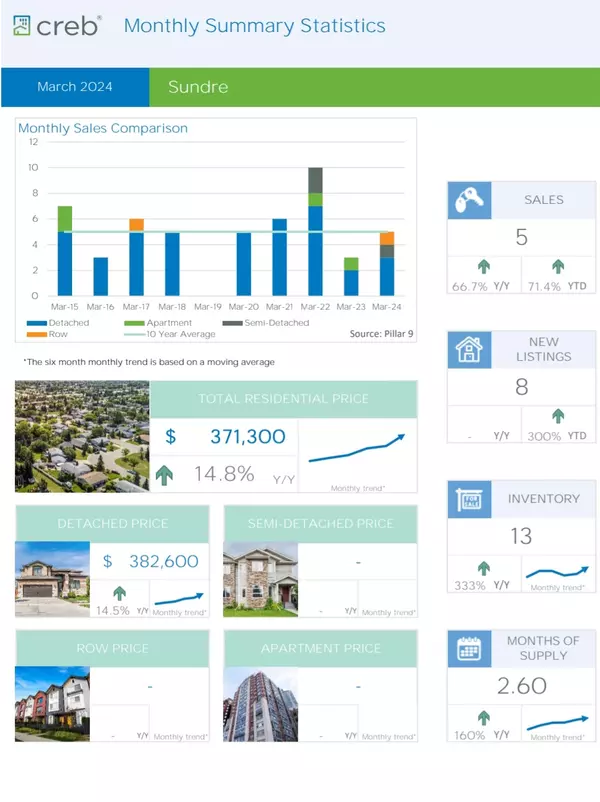

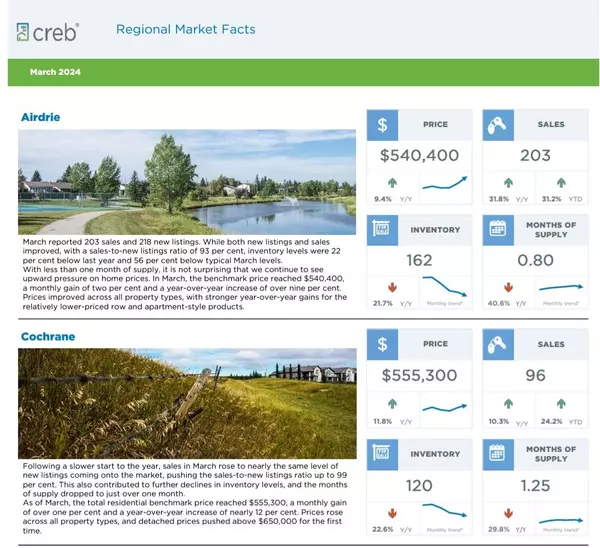

Knowledge of the local real estate market is essential when buying a home. This includes understanding average home prices, neighborhood trends, and what amenities are important in your desired area. If you've done your homework—attended open houses, researched online listings, or spoken with local real estate agents—you’ll feel more confident making an informed decision when it comes time to buy.

5. Long-Term Plans

Home ownership is not just about finding a place to live; it’s also about making long-term commitments. If you see yourself staying in one location for at least five years or more, buying may be more advantageous than renting. Consider factors like job stability, family plans, and community ties when evaluating whether you're ready for this commitment.

6. Willingness to Take on Responsibilities

Owning a home comes with its fair share of responsibilities—maintenance, repairs, property taxes, and homeowner's insurance are just a few examples. If you're willing to invest time and effort into maintaining your property rather than relying on someone else (as you would with renting), then you may be ready for home ownership. Assess whether you're prepared to tackle these responsibilities head-on before committing.

7. Emotional Readiness

Lastly, emotional readiness is an often overlooked aspect of preparing for home ownership. Buying a house can be stressful—there will be negotiations, paperwork, inspections, and potential setbacks along the way. If you feel excited rather than overwhelmed by the prospect of buying your own home—and if you're prepared to navigate both the highs and lows of this journey—you may be ready to take this significant step.

Conclusion

Becoming a homeowner is an exciting milestone that comes with numerous benefits—stability, investment potential, and personal fulfillment among them. However, it’s crucial to ensure that you’re genuinely prepared before diving into this commitment.

If you recognize these seven signs in yourself—stable income, good credit score, sufficient savings, market knowledge, long-term plans, willingness to take on responsibilities, and emotional readiness—you may be well on your way toward owning your dream home.

Before making any final decisions, consider consulting with real estate professionals who can guide you through the process based on your unique circumstances. With careful planning and consideration, you'll not only find the right property but also set yourself up for success as a new homeowner!

Categories

Recent Posts

Leave a reply