How to Save Money for Your First Home: A Practical Guide

How to Save Money for Your First Home: A Practical Guide

Thinking about buying a home but need to save money first? The journey to

homeownership begins with a solid savings strategy. Here are some practical tips to

help you reach your goal:

1. Create a Dedicated Savings Plan

A focused savings strategy can make all the difference. Open a separate savings

account specifically for your home fund. This separation helps prevent you from dipping

into your savings for everyday expenses. Set up automatic transfers from your primary

account to your home fund—this creates consistency and takes the guesswork out of

saving.

2. Track Spending and Cut Back

To save effectively, you need to know where your money is going. Review your monthly

expenses and identify areas where you can trim costs. Could you cut back on dining

out, streaming services, or impulse purchases? Small adjustments, like brewing coffee

at home or meal-prepping, can add up over time and accelerate your savings.

3. Boost Your Income

If cutting back on expenses isn’t enough, consider ways to increase your income. A side

gig, freelancing, or selling unused items can bring in extra cash. Whether it’s a weekend

project or selling clothes you no longer wear, these additional income streams can help

you build your savings faster without making major lifestyle changes.

4. Pay Down High-Interest Debt

High-interest debt, such as credit card balances, can eat away at your ability to save.

Focus on paying down high-interest loans to free up more of your income. Lowering

your debt can also improve your credit score, which will be crucial when you apply for a

mortgage.

5. Research Down Payment Assistance Programs

Many local, provincial, and federal programs offer grants, low-interest loans, or other forms

of assistance to help first-time homebuyers with their down payment. Explore these

options to see if you qualify. Programs can vary by location, so reach out to a real estate

expert or financial advisor for guidance.

Buying a home starts with a clear plan and small, consistent steps. Every effort you

make today brings you closer to the keys to your future home. Whether you’re just

getting started or have questions about navigating the process, I’m here to help! Reach

out for personalized advice—your dream of homeownership is within reach.

Categories

Recent Posts

Mountain View Region Monthly Summary Statistics February 2025

How to Save Money for Your First Home: A Practical Guide

How To Increase Your Home's Value

7 Signs That You Are Ready For Home Ownership

Adventure in the Valley: Experience Cochrane, Alberta

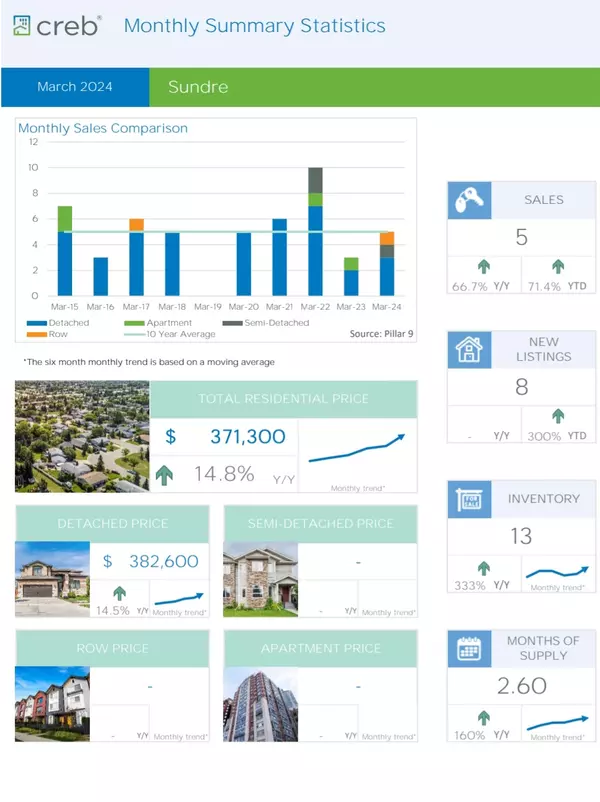

March 2024 Sales Summary for Sundre

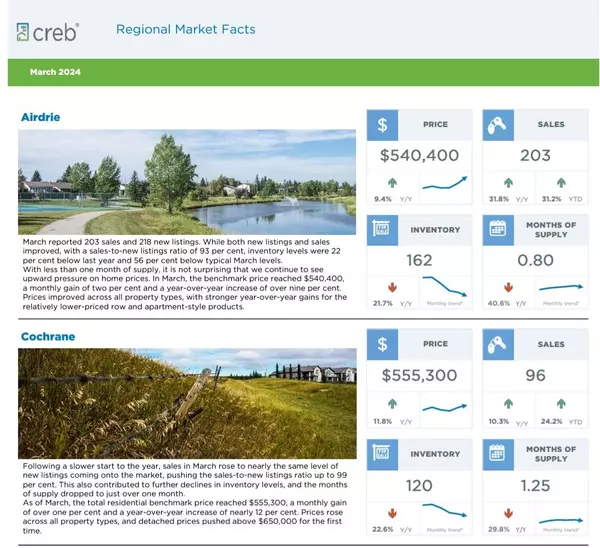

March 2024 Sales Summary for Airdrie and Cochrane

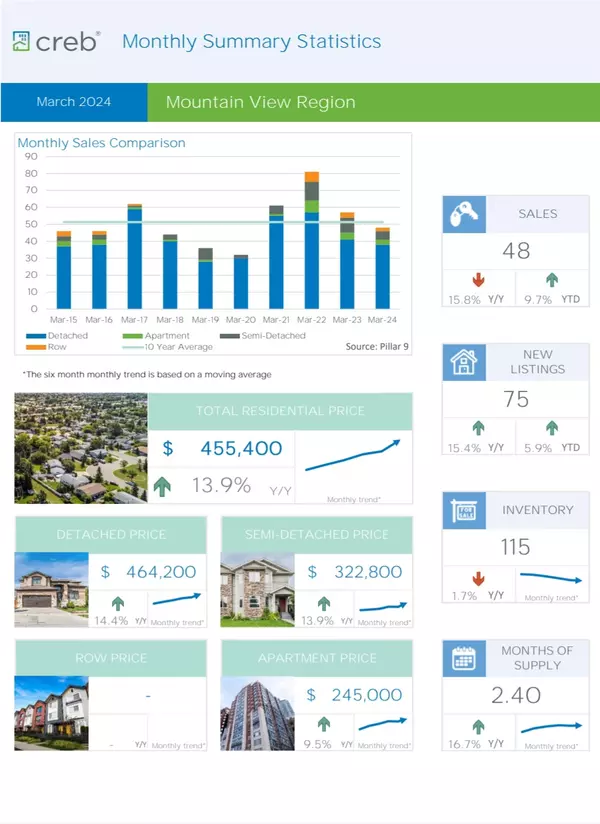

March 2024 Sales Summary for Mountain View County

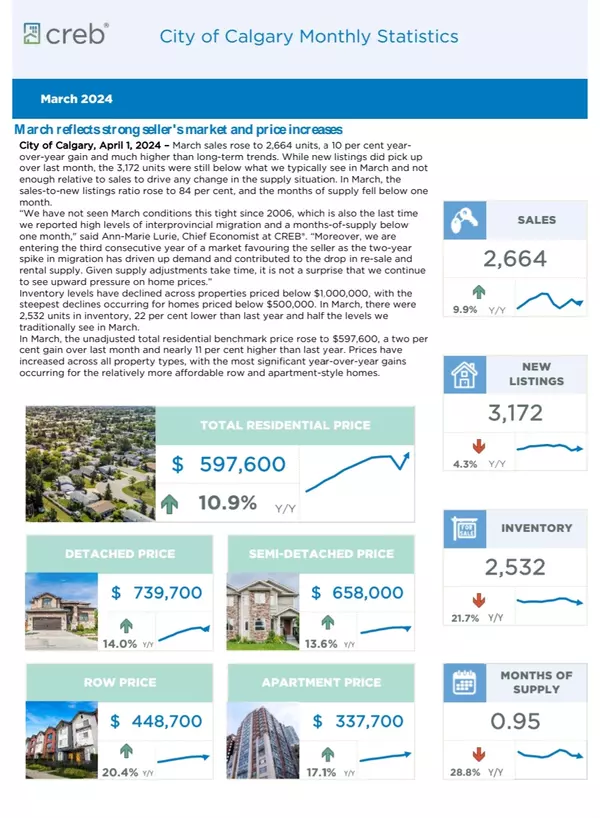

March 2024 Sales Summary for Calgary

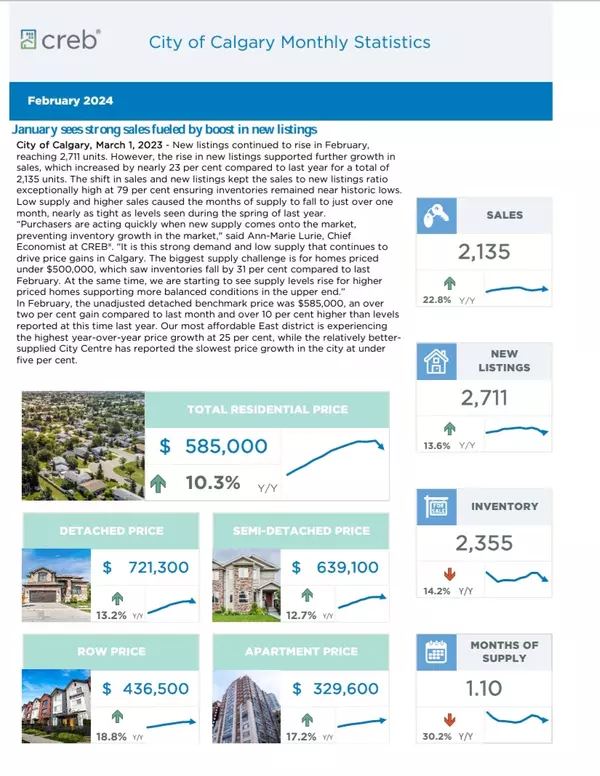

February 2024 Sales summary for Calgary

Leave a reply